OVERVIEW

THE SOLUTION

THE DESIGN PROCESS

Human-Centred Design Approach + The Double Diamond Framework + Transition Design

Applying the Double Diamond Framework as the core design process, we integrated Human-Centred Design and Transition Design methods to uncover underlying issues and craft future-focused solutions.

THE DESIGN PROCESS

Human-Centred Design approach + The Double Diamond Framework + Transition Design

Utilising the Double Diamond Framework as the foundational design process, I integrated Human-Centred Design and Transition Design methods to identify the underlying issues and devise solutions.

DISCOVER

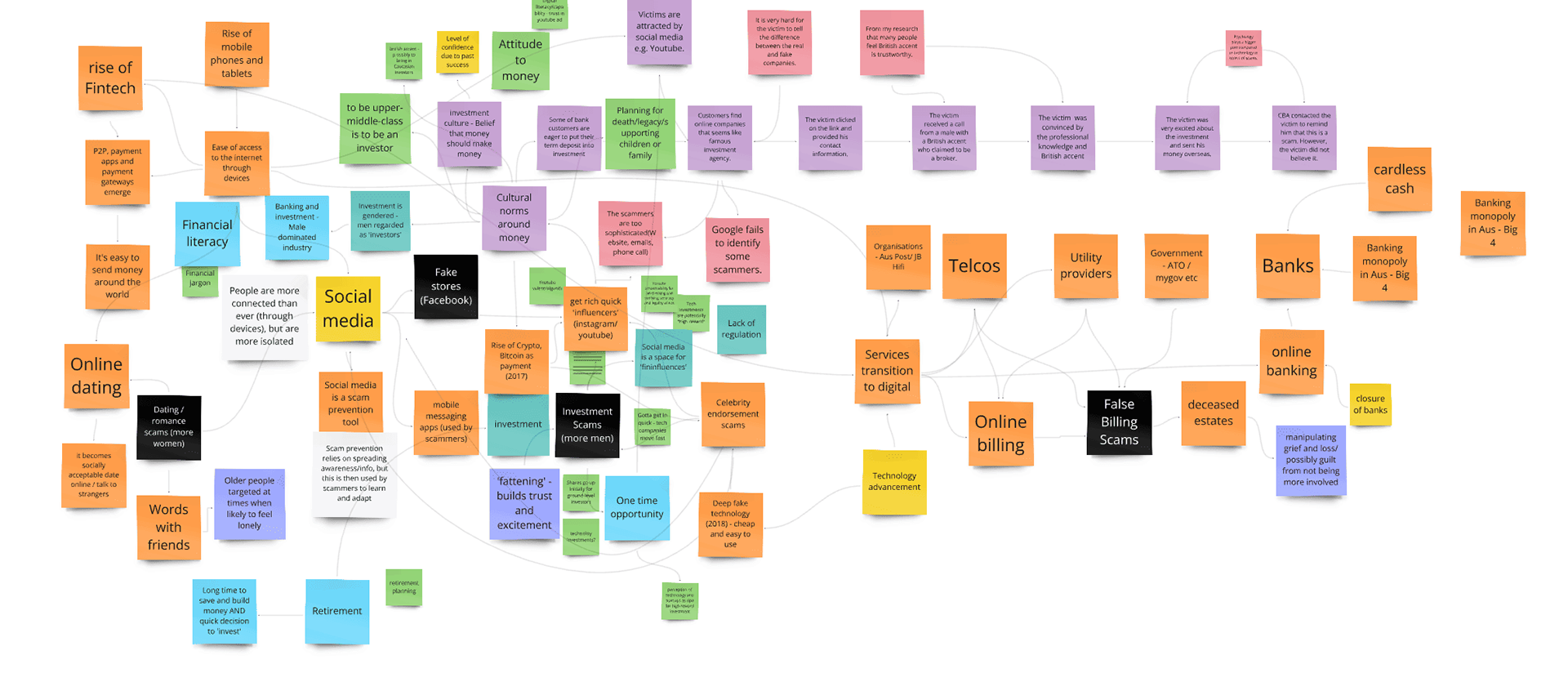

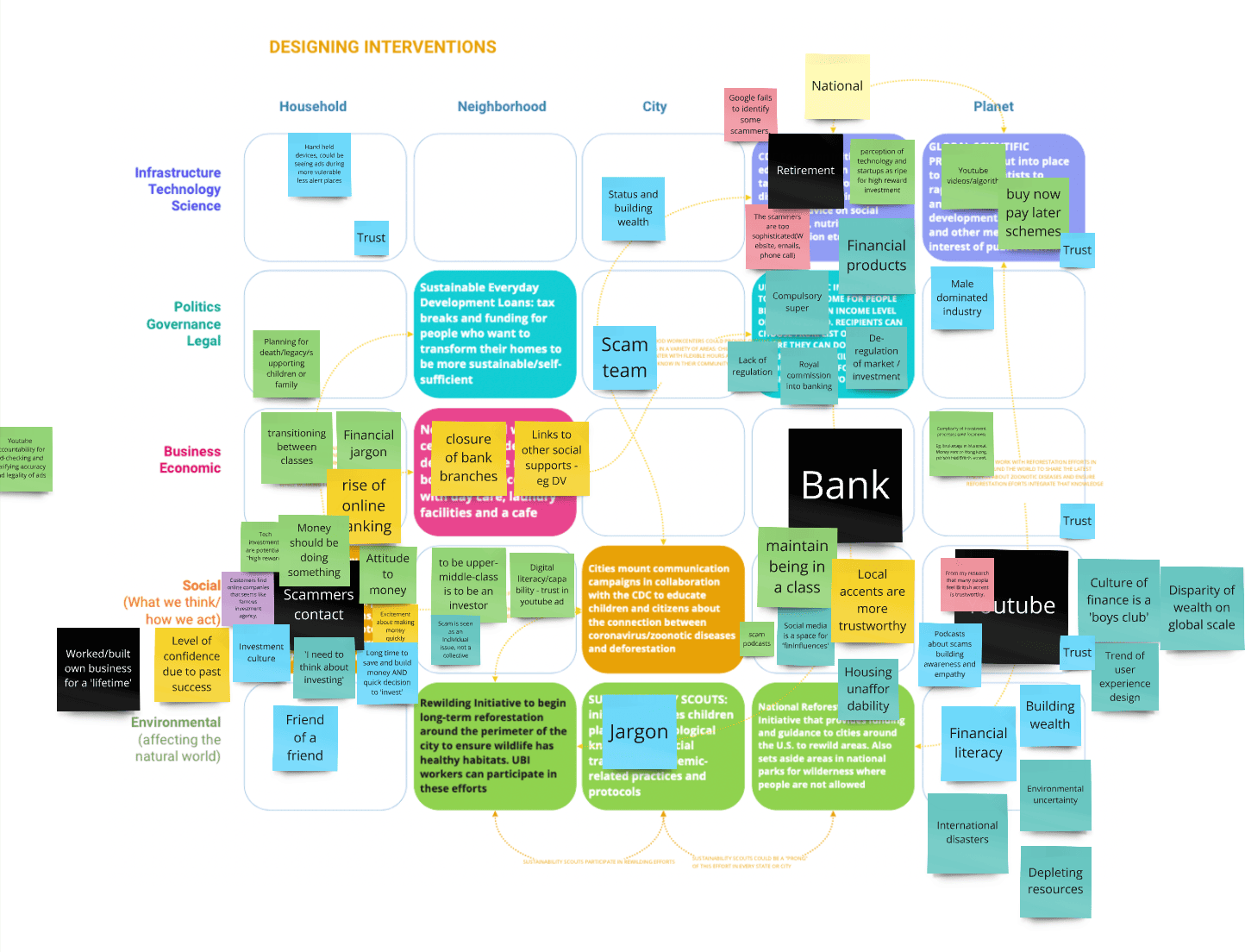

Our research approach encompassed an in-depth analysis of statistics, literature reviews, and the historical context of financial issues. We conducted stakeholder interviews and virtual conversations with diverse age groups who had firsthand experience with scams. From the research insights, we developed three personas, constructed several system diagrams, and identified significant paradoxes.

Personas

Stakeholder Relations

By visualising the diverse relationships, aspirations, and worries surrounding financial scams among various stakeholder groups, it became evident that these connections are often characterised by imbalanced power dynamics, conflicts, and a lack of visibility. This mapping exercise has the potential to facilitate the identification of commonalities and areas of agreement among stakeholders, which can be harnessed to create opportunities for early intervention and collaborative solutions.

Paradoxes and Tensions

Through the research, we identified a list of 18 paradoxes showing the complexity within the problem space. Those paradoxes have many opposing forces that make the problem difficult to solve.

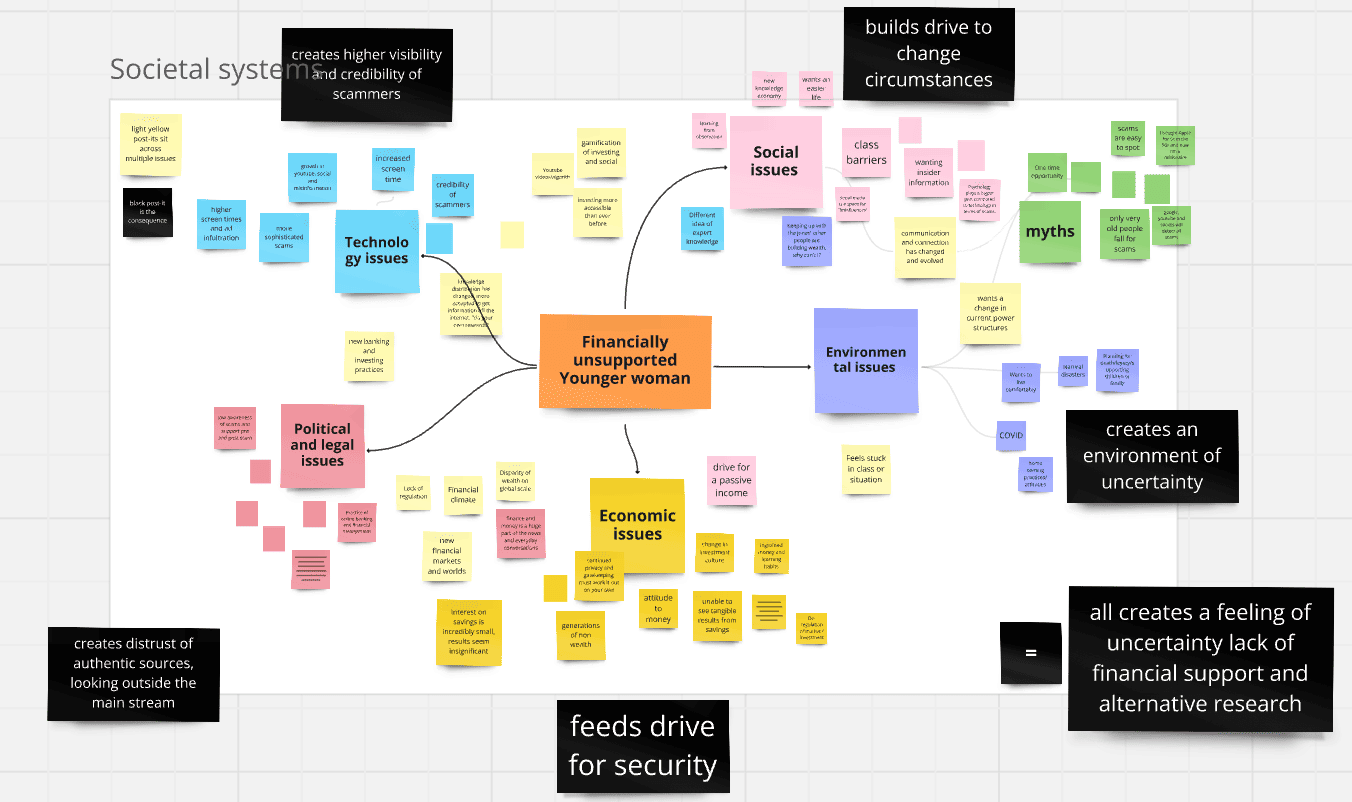

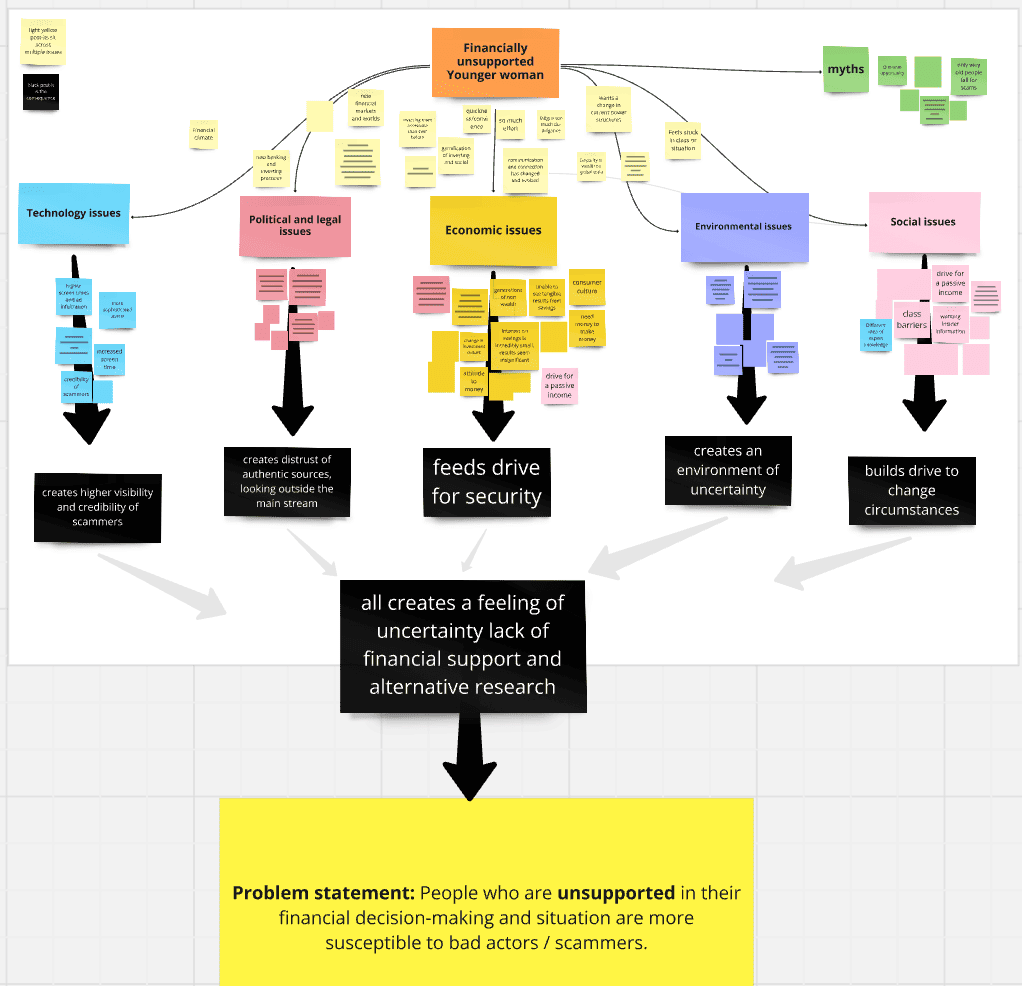

DEFINE

Problem Framing

We analysed the social and systemic elements involved to identify the problem statement.

Problem Statement

People who are unsupported in their financial decision-making and situation are more susceptible to scammers.

We consider the problem from a systemic and temporal perspective to identify three main shifts in culture, financial systems and technology, and practices that have led to the problem.

DEVELOP

Visioning

Our team envisioned a future where investing becomes an inclusive, community-centred practice accessible to individuals across diverse social classes, focusing on generating both monetary and societal value. To achieve this, investment practices must shift away from patriarchal and heteronormative norms towards feminist and egalitarian values. This vision promotes communal, values-based, and compassionate investing, intergenerational and interclass knowledge-sharing, and a culture grounded in care.

DELIVER

Backcasting

We have developed two solutions to support the immediate risk and consequence of investment scams and the pathways to communal investing. It involves addressing the risk of scams, equipping people with the skills to invest, and establishing investing as a social meaning-making practice steeped in community and care. These solutions are ‘Life Savers’ and an ‘IKEA of finance and investing’, titled ‘Investment world’.

"Life Savers" lays the groundwork for establishing and engaging in collaborative investing groups, ensuring a solid foundation for financial growth and security.

‘Investment world’ provides a world where people can see and conceptualise the impact of investing through public exhibitions. Seminars and workshops curated by LifeSavers help build a community around shared values.

Transition pathway

How might we transition from current solutions to a safe and supported investment environment?

The Storyboard of Life Savers and Investment World

THANK YOU FOR WATCHING!